The One Big Beautiful Bill Act

On July 3, the House narrowly passed the One Big Beautiful Bill Act (OBBBA) with a 218–214 vote. According to the nonpartisan Congressional Budget Office (CBO), the bill will add an estimated $3.3 trillion to the budget deficit over the next 10 years. Trump signed the bill the next day on July 4.

To help pay for it, OBBBA cuts funding to Medicaid, SNAP (food assistance), and clean energy tax credits, while also raising the federal debt ceiling by $5 trillion. Unfortunately, the CBO also estimated that 11.8 million people could lose health insurance coverage because of the legislation’s Medicaid cuts and other provisions.

A recent Quinnipiac University poll found that 53% of registered voters oppose the bill, while only 27% support it. In other words, it’s deeply unpopular, but all we can do now is examine its implications.

If you have a job with health and retirement benefits, and you’re pursuing financial independence or early retirement (FIRE), this bill should work in your favor. Why? Because when taxes go down, your ability to save, invest, and build wealth goes up.

Key Provisions of OBBBA That Affect FIRE Seekers

For background, I helped kickstart the modern-day FIRE movement in 2009 when I launched Financial Samurai and began sharing my journey to escape the finance industry and retire early.

In 2012, I negotiated a severance package and haven’t returned to full-time work since. Instead, I’ve focused on writing for this site, publishing books, and fatherhood. Everything I write is based on firsthand experience because money is too important to leave to guesswork.

The road to financial independence is full of twists and turns, so it’s important to stay ready for change. Here are the key tax and savings provisions from the OBBBA that can help FIRE followers accelerate their journey.

1. Slightly Greater Risk Of Losing Affordable Health Insurance

The most commonly asked question for those considering early retirement is: Do I have enough money? A close second is: How will I afford health insurance?

The U.S. is one of the few developed countries where affordable health care is closely tied to employment. If you retire before age 65—when Medicare kicks in—you’ll need to get health insurance through the Affordable Care Act (ACA) marketplace.

Previously, if your household income exceeded 400% of the Federal Poverty Level (FPL), you were ineligible for premium subsidies. This is called the subsidy cliff. However, after previous legislation, subsidies are now based on a sliding scale, and there is no longer a hard income cutoff at 400% FPL. This means even higher-income early retirees may still qualify for subsidies—especially if ACA premiums exceed 8.5% of their income.

That said, depending on who you ask, between 10 and 16 million people may lose health insurance coverage over the next decade. One major reason is the planned reduction in enhanced ACA tax credits—particularly for those earning more than 400% of the Federal Poverty Level (which is $124,800 for a family of four in 2025). On average, these enhanced tax credits have reduced premium payments by $705 per year for eligible enrollees.

Other contributing factors include:

- A shorter open enrollment window (reduced from January 15 to December 15, starting November 1), so stay organized

- New income verification requirements for those applying for premium tax credits, and

- Restrictions on coverage for DACA recipients.

25X Household Expenses In Investments Is Uncomfortably Low

If you rely on health insurance subsidies to make early retirement feasible, try to keep your income under 400% of the FPL. Otherwise, you may face significantly higher premiums—or be forced to work longer.

One workaround is to start a small business with your spouse or partners, allowing you to get group health insurance and deduct the cost from your business income, effectively reducing your premiums by your business’s marginal federal tax rate. However, this approach only makes sense if the business earns enough to justify the expense.

For context: when my wife retired in 2015 and I could no longer piggyback on her employer-subsidized plan, we began paying $1,680/month for a Gold plan for just the two of us. Today, with a family of four, we’re paying $2,500/month for a Silver plan. It’s a steep cost, but one we’ve accepted as the price of financial freedom.

After not having a day job since 2012, I truly do not believe having an investable net worth equal to 25X annual household expenses is enough to comfortably retire early. You can see the evidence by men who claim FIRE and still pressure their wives to work, or those who claim FIRE and still earn supplemental income, like me. You need a greater cushion if you want to feel comfortable, something closer to 35X annual expenses or more.

Before you retire early, do the following:

- Estimate your total household income post-retirement.

- Compare it against the 400% FPL threshold to determine if you qualify for ACA subsidies.

- Input a realistic annual healthcare cost into your retirement budget and multiply it by 25X to 50X to ensure you have enough in investments.

- Go on a health kick during your last working year—get in the best shape of your life to minimize future medical expenses.

Here’s the thing: at a 4% rate of return, you’d need $3,120,000 in investments to generate $124,800 a year (400X of FPL for a household of four). The $3,120,000 doesn’t even include the value of your primary residence, which could easily be worth over $1,000,000.

So if you and your spouse retire early with two dependents, do you really need health care subsidies as multi-millionaires? Most would argue no. Some might even argue that accepting health care subsidies with a seven-figure net worth is immoral.

2. Child Tax Credit Increased

- The credit increases to $2,200 per child (up from $2,000), adjusted for inflation.

- Phases out starting at $400,000 (MFJ) or $200,000 (others).

- Valid Social Security numbers are still required.

As a parent of two young children, achieving FIRE without kids is far easier than doing so with them. Maintaining FIRE is also more challenging once you have children, as your biggest expenses—housing, healthcare, and education—are the ones most impacted by inflation.

This gives parents a little more breathing room while raising kids, especially in high-cost areas. A $200,000 to $400,000 income phaseout is still quite generous, even for those living in high-cost areas.

3. 529 Plan Expansion

- Now allows tax-free distributions for private and religious K–12 schooling.

- Also covers postsecondary credentialing expenses, aligning with the Lifetime Learning Credit.

This may not feel entirely new, since we already know that up to $10,000 a year from a 529 plan can be used for private K–12 education. However, the OBBBA now firmly cements this flexibility into law.

For FIRE-minded parents, try to contribute enough to match the current 4-year cost of your target college. If you can get there, the growth of your 529 plan has a decent chance of keeping up with tuition inflation. Just keep in mind for those looking to gain free money for college: a large 529 balance will likely reduce eligibility for need-based financial aid, though it won’t affect merit-based aid.

4. SALT Deduction Cap Raised

- Increases the SALT cap to $40,000 from $10,000, rising 1% annually through 2029.

- Reverts back to $10,000 in 2030.

- Begins phasing down for incomes over $500,000.

If you live in a high-tax state, this provides meaningful short-term relief. Raising the SALT (State and Local Tax) deduction cap should also provide a valuation boost to real estate in high cost of living cities.

As someone who has lived in New York City and San Francisco since 1999, raising the SALT deduction cap is beneficial to my family. The next city we’re seriously considering is Honolulu, which also has higher-than-average income taxes. Although Hawaii does have the lowest property tax rate in the nation.

5. AMT Relief Made Permanent

- AMT exemptions are now permanently indexed to inflation.

- 2025 figures:

- $88,100 (single), phased out at $626,350

- $137,000 (MFJ), phased out at $1,252,700

This protects more upper-middle-class families from surprise tax bills as incomes rise. The income figures for AMT exemptions look to be quite generous.

6. New “Trump Accounts” for Kids

- Tax-advantaged accounts for children under 8.

- Contribute up to $5,000/year, grows tax-deferred until age 18, however, the contribution isn’t a tax deduction

- Can be used for college, first home, or starting a business.

- Qualified withdrawals will be treated as capital gains and taxed at the applicable long-term capital gains rate.

- A $1,000 government seed contribution (free money) for qualifying kids born between January 1, 2025–2029.

These accounts promote long-term saving and investing from an early age—a core value of the FIRE movement. I’m just not sure how the proposed $1,000 contribution per child born during this period will be funded. However, any initiative that encourages people to have more children and invest in their future is a step in the right direction.

I recommend that every FIRE parent open both a custodial investment account and a custodial Roth IRA for their children as early as possible. The earlier you start contributing—and encouraging your children to earn income—the stronger their financial habits and the greater their potential to build lasting wealth.

Custodial accounts also make it easier to buy the dip. Even if you’re hesitant to invest for yourself, it’s often easier to stay brave when you’re investing for your children’s future. So in total, we can invest in a 529 plan, custodial investment account, custodial Roth IRA, and “Trump Account” for each child. Time to get going!

7. Temporary Tip Income Deduction

- Up to $25,000 in tips deductible from 2025–2028.

- Applies to non-itemizers in tipped industries.

- Still reportable for payroll taxes and state/local taxes.

If you’re side hustling or in service work while building up savings, this is a nice perk. Although, I’m not sure most people who earn tips pay taxes on those tips in the first place.

8. Temporary Overtime Pay Deduction

- Deduct up to $12,500 (or $25,000 MFJ) of overtime pay from 2025–2028.

- Phases out at $275,000 (single) or $550,000 (MFJ).

This is a great tax break for those putting in extra hours to escape the rat race faster. To this day, I don’t know anyone who works 40 hours a week or less and also wants to retire early. In fact, since the pandemic, more people are working multiple remote jobs to double or even triple their income.

The 40-hour workweek is an outdated construct. If you want to earn more than the average person, you’ll likely need to work more than the average person. And if overtime pays more and is now less taxed—great! Thanks to the OBBBA, there’s now even more incentive to put in extra hours and reach financial freedom sooner.

9. Car Loan Interest Deduction (Temporary)

- Deduct up to $10,000 in interest on U.S.-assembled vehicles (2025–2028).

- Phases out at $100,000 (single) or $200,000 (MFJ).

- RVs and campers excluded.

If you need a car but hate the idea of non-deductible debt, this provision takes a bit of the sting out. That said, hopefully everybody follows my 1/10th rule for car buying and doesn’t take out a loan to buy a depreciating asset. Owning too much car is a top wealth killer in America.

If you need to buy a car, be sure to follow my House-to-Car Ratio formula to stay on track for FIRE. Aim for a ratio of at least 20 if you don’t want to work forever. The average American has a ratio of between 8 – 10, and your goal is to try and thoroughly be above average.

10. Federal Estate Tax Exemption Made Permanent

- Exemption locked in at $15 million/person for 2026 and beyond, adjusted for inflation. This is up from $13.99 million/person in 2025.

Although the estate tax only affects about 1% of households, this is a nice win for those in the Fat FIRE camp who are seeking to create generational wealth. Shooting for a net worth equal to the federal estate tax exemption threshold is one net worth target to shoot for.

If the estate tax exemption amount wasn’t extended beyond 2025, it would have dropped in half starting in 2026 and beyond. If so, the “death tax” would have ensnared a lot more households, especially due to inflation and the rise of risk assets.

One of the more popular provisions of the OBBBA is the $6,000 “senior deduction” for Americans aged 65 and older. While it doesn’t fully eliminate taxes on Social Security, it does help—by increasing the percentage of seniors who owe no taxes on their benefits from 64% to 88%, according to estimates by President Trump’s Council of Economic Advisers.

In other words, around 14 million more seniors are expected to see some relief from taxes on their Social Security income.

But as always, not everyone benefits. The full $6,000 deduction applies only to seniors making up to $75,000 as individuals or $150,000 for joint filers. The deduction then begins to phase out, disappearing entirely at $175,000 for singles and $250,000 for couples.

For context, the median income for seniors in 2022 was roughly $30,000. So while the senior deduction makes for great headlines, the truth is that most seniors already pay little to no taxes on their Social Security. As such, the actual benefit may be marginal for the typical retiree.

Given that Social Security is underfunded by about 25% and projected to run out of full benefits by 2034 if no changes are made to eligibility or payouts, expanding deductions now puts even more strain on the system. It’s great if you can collect the money today, but not so great for future generations.

Business Owner Wins That Support Financial Independence Seekers

One of the best ways to achieve financial independence is by starting a business and building equity. I dedicate a chapter to entrepreneurship in my USA TODAY bestseller, Millionaire Milestones: Simple Steps to Seven Figures. The crux of the chapter is how business equity can multiply as your revenue and profits grow—unlike a salaried job, where income is largely linear and tied to time.

1. 20% Pass-Through Deduction Made Permanent

- The Section 199A deduction lives on.

- Applies to income from LLCs, S corps, sole props.

- The proposed increase to 23% was cut, but 20% remains locked in.

This is a major win for entrepreneurs, freelancers, and side hustlers—all pillars of FIRE strategy. It is unwise to only rely on your day job to achieve financial independence. The more income streams you have, the better.

3. Section 1202 Stock Gains Exclusion

- Keeps the tiered QSBS rules:

- 50% exclusion for 3+ years

- 75% for 4+ years

- 100% for 5+ years

- Increases gain exclusion cap to $15 million (from $10 million), inflation-adjusted.

The higher QSBS exclusion cap of $15 million is ideal for FIRE folks investing in startups as angel investors. At the margin, this change should encourage more people to invest in early-stage companies, which is great for the startup ecosystem.

It’s similar to how homeowners can sell their primary residence and exclude up to $250,000 in gains tax-free as individuals, or $500,000 if married filing jointly. Knowing there’s a generous tax break on the back end makes investing in a nicer home—or a promising startup—all the more appealing.

The federal government continues to show strong support for startups and small-business owners. The 2012 JOBS Act was a major step forward, and this latest update builds on that momentum. As a result, investors should consider allocating more capital to private businesses—especially since startups are staying private longer.

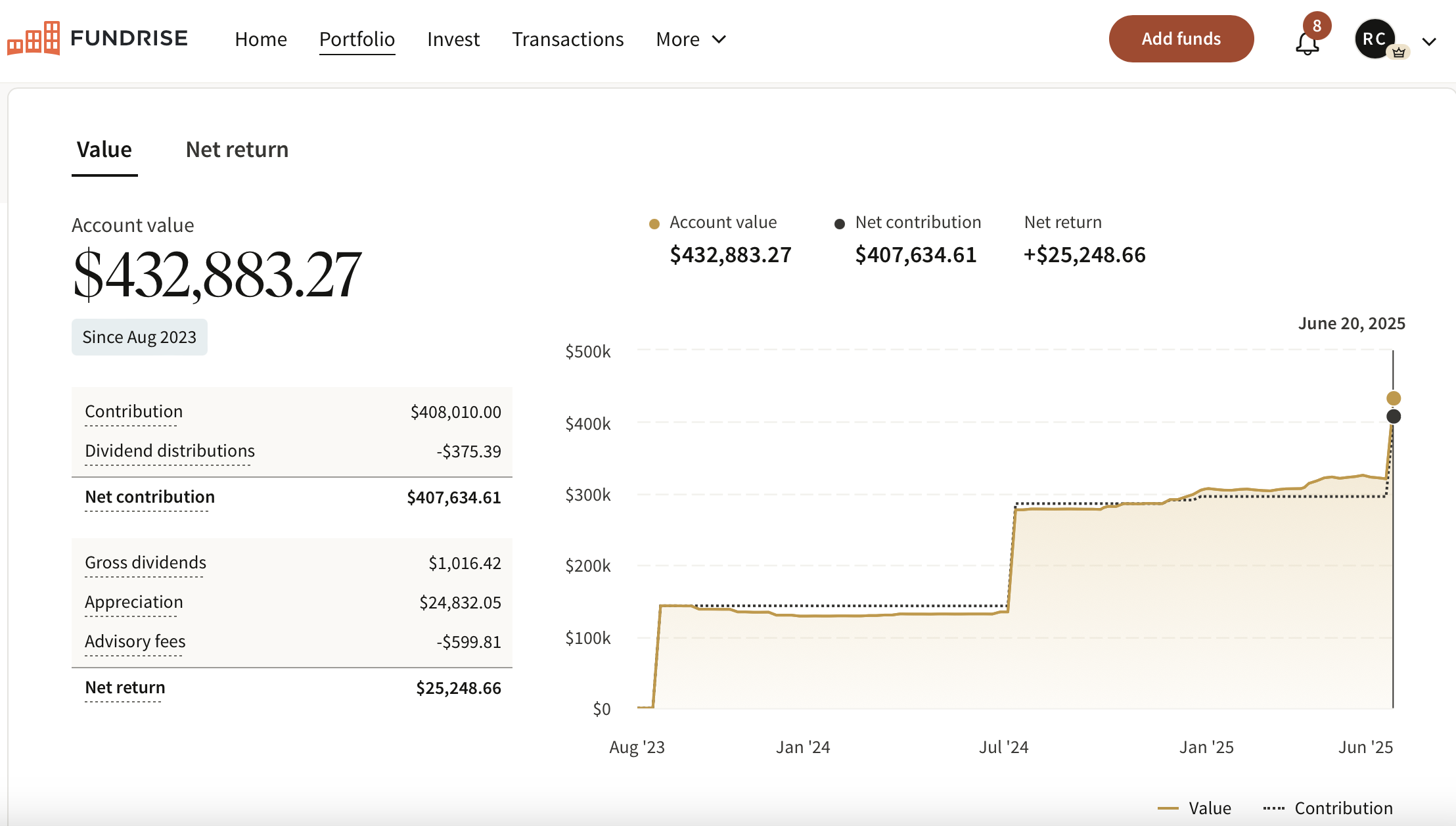

Personally, I’m methodically building my position in private AI companies through Fundrise Venture, which owns stakes in OpenAI, Anthropic, Databricks, Anduril, and more. Fundrise is also a long-time sponsor of Financial Samurai, and our investment philosophies are closely aligned.

3. 100% Bonus Depreciation Made Permanent

- Businesses can write off asset purchases immediately.

- Section 179 expensing raised to $2.5 million, phase-out at $4 million.

This change is great for cash-flow-focused FIRE builders reinvesting in small businesses, as well as for CAPEX-heavy businesses that require costly equipment. Since the pandemic, there’s been a noticeable trend of private equity firms acquiring traditional small businesses—like dental practices, urgent care centers, physical therapy clinics, laundromats, construction firms, and fitness studios.

Since writing about FIRE in 2009, I consistently see people the FIRE community retire from their day jobs and start businesses to see what they’re capable of building on their own. There’s something deeply rewarding about creating something from nothing.

OBBBA Helps FIRE Seekers At The Margin

While it’s not a perfect bill—and critics rightly point out its impact on the deficit and cuts to social programs—OBBBA provides several meaningful wins for those on the path to financial independence:

- Lower taxes = more capital to invest to create more passive income

- Expanded deductions = increased flexibility

- New benefits for kids = multigenerational wealth building

- Business relief = stronger cash flow and reinvestment potential

The greatest advantage of the FIRE movement is the freedom of time and place. And with recent tax law changes offering a few more incentives to save and build, the road to early retirement just got a little smoother.

That said, don’t count on the OBBBA—or the federal government in general—to help you reach financial freedom. Regardless of the latest bill or who’s in office, the responsibility falls on you. Focus on what you can control: your work ethic, consistency, saving rate, investment strategy, and your appetite for risk.

Sometimes the government will be a headwind on your path to FI. But for now, due to the OBBBA, there’s a modest tailwind helping you move a little faster toward your goal.

Readers, what are your thoughts on the One Big Beautiful Bill Act? How does it impact your finances? Are there any provisions I didn’t mention that you think could help accelerate your path to financial freedom?

Free Financial Analysis Offer From Empower

If you have over $100,000 in investable assets—whether in savings, taxable accounts, 401(k)s, or IRAs—you can get a free financial check-up from an Empower financial professional by signing up here. It’s a no-obligation way to have a seasoned expert, who builds and analyzes portfolios for a living, review your finances.

A fresh set of eyes could uncover hidden fees, inefficient allocations, or opportunities to optimize—giving you greater clarity and confidence in your financial plan.

The statement is provided to you by Financial Samurai (“Promoter”) who has entered into a written referral agreement with Empower Advisory Group, LLC (“EAG”). Click here to learn more.

Diversify Your Retirement Investments

Stocks and bonds are classic staples for retirement investing. However, I also suggest diversifying into real estate—an investment that combines the income stability of bonds with greater upside potential.

Consider Fundrise, a platform that allows you to 100% passively invest in residential and industrial real estate. With almost $3 billion in private real estate assets under management, Fundrise focuses on properties in the Sunbelt region, where valuations are lower, and yields tend to be higher.

In addition, you can invest in Fundrise Venture if you want exposure to private AI companies like OpenAI, Anthropic, Anduril, and Databricks. AI is set to revolutionize the labor market, eliminate jobs, and significantly boost productivity. We’re still in the early stages of the AI revolution.

I’ve personally invested over $400,000 with Fundrise, and they’ve been a trusted partner and long-time sponsor of Financial Samurai. With a $10 investment minimum, diversifying your portfolio has never been easier.

Join 60,000+ readers and subscribe to my free Financial Samurai newsletter here. You can also get my posts delivered to your inbox as soon as they are published by signing up here. Financial Samurai began in 2009 and is the leading independently-owned personal finance site today. Everything is written based off firsthand experience.

Source: The One Big Beautiful Bill Act