What is an Interval Fund?

I was poking around the Bogleheads forum when I discovered this thread about an interval fund.

I’ve heard of all kinds of funds, but this is the first time I’ve heard about interval funds. Regarding funds, I’m pretty much an index mutual fund or index exchange-traded fund (ETF). They’re all at Vanguard, though I think Fidelity, Charles Schwab, and all the other low-cost providers are great, too.

Interval funds are a completely different animal, and, in this case, the original poster invested in a Variant Alternative Income Fund (NICHX):

Thank you in advance for your time. Two years ago I was dealing with some anxiety in my life. My wife and I made the decision to enlist an advisor to manage a portion of our holdings. That turned out not to be the right thing to do and he did not serve us well. We have terminated his contract and now I am working to reallocate our accounts into more appropriate funds.

He invested a not-insignificant amount of funds into a Variant Alternative Income Fund (NICHX). I guess it’s considered an “interval fund.” That I can only exit quarterly. The price-per-share has been flat, but it pays a decent quarterly dividend that is automatically reinvested. An initial investment of $103k in late 2022 has paid over $15k in dividends over six quarters (545 new shares).

This of course triggers the very anxiety I struggle with. My intention was to get to a 70/30 AA. I guess my options are:

1) Get out of the fund as soon as the next quarterly-sell period opens.

2) Keep all or some and attribute it either to the equity side or the bond/cash side of my AA.

3) Keep all or some of it, but leave it outside of my AA (meaning pretend it’s not there).Your wisdom is welcome.

Table of Contents

An interval fund is a mutual fund that is a closed-end fund where you can only sell your shares during a repurchase period. This period varies from fund to fund but many are on a quarterly interval and the fund will state how many of their outstanding shares they will repurchase (redeem), usually stated as a percentage.

If you read “closed-end fund” and then “redemption periods” and already knew what a closed-end fund was, this could be confusing. Typically, closed-end funds issue shares at an IPO and then never buy them back. The shares can trade on the open market, but new money doesn’t go back into the fund.

With an interval fund, they are in between open-end and closed-end funds because they can offer new shares but only redeem them at various intervals (quarterly, semi-annually, etc.) and only for a set percentage of assets.

I bet you can see how things get tricky because this fund is relatively illiquid. If an interval fund says they’ll repurchase 10% and more than 10% of the shares want to be repurchased, everyone gets pro-rated down.

This structure benefits the interval fund because a lot of redemptions can cause problems for the fund, as it has to come up with the money to give back to shareholders. With a set cadence for dealing with redemptions, the manager can plan for them (both in timing and size).

The scheduled redemptions allow managers to invest in more complex securities and contracts, which may themselves be more illiquid.

NICHX: Peek at an Interval Fund

The Bogleheads post mentioned NICHX, so I thought I’d look closer at this.

NICHX is interesting – it invests in unconventional income-generating assets like litigation finance, royalties, etc. It’s a fixed-income fund, so don’t compare it to an S&P 500 index, and it invests in alternative cash flow assets that I’ve looked at previously.

It’s an interval fund that doesn’t trade on the open market, so the only way to sell your shares is through NICHX. Unlike many interval funds, though, there doesn’t appear to be a sales charge.

You can see that NICHX compares itself with many fixed-income assets, such as the Bloomberg U.S. Aggregate Bond Index and Bloomberg U.S. High Yield Bond Index, which seems reasonable. They beat the completely principal-safe T-bills and compare favorably with high-yield corporation bonds and the like.

With interval funds, it’s important to understand the approach and asset classes that they invest in, as well as the fees. These funds do a lot more than tracking an index, so they typically charge much more.

For NICHX, we see that they have a net expense ratio of 1.67% (which includes the Management fee of 0.95%). Also, NICHX only allows a quarterly redemption of 5% of the fund’s net asset value.

Is this expensive? It looks expensive compared to an S&P500 Index fund that charges you only 0.04%, but that’s not a fair apples-to-apples comparison because they’re invested in different things with different risk profiles.

You have to compare it with something that invests in alternative investments.

Yieldstreet Alternative Income Fund

Yieldstreet offers a Yieldstreet Alternative Income Fund that benchmarks against the Bloomberg U.S. Aggregate Bond Index and Bloomberg U.S. High Yield Bond Index. It invests in income-producing alternative assets like commercial real estate, aircraft, legal finance, supply chain finance, art finance, etc.

They also limit redemptions to 20% of shares outstanding in the prior calendar year or no more than 5% in each quarter, on a quarterly basis—the same as NICHX.

As for fees? 1.50%. It’s slightly cheaper than NICHX but within the same ballpark. (no sales load either)

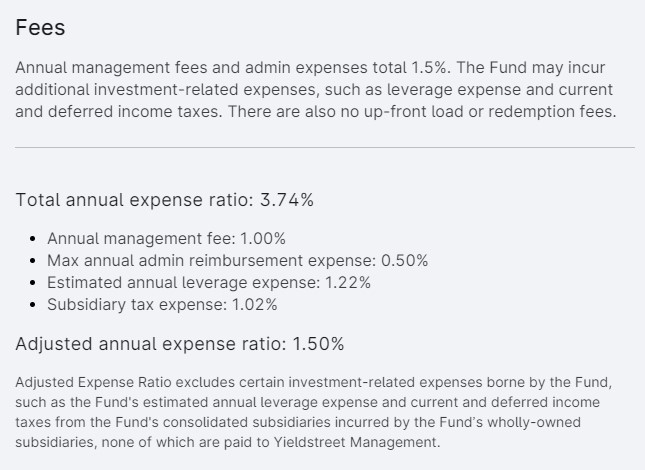

The part that is slightly confusing about this fund is that they list this as their fees:

If that’s hard to see:

Fees

Annual management fees and admin expenses total 1.5%. The Fund may incur additional investment-related expenses, such as leverage expense and current and deferred income taxes. There are also no up-front load or redemption fees.

Total annual expense ratio: 3.74%

- Annual management fee: 1.00%

- Max annual admin reimbursement expense: 0.50%

- Estimated annual leverage expense: 1.22%

- Subsidiary tax expense: 1.02%

Adjusted annual expense ratio: 1.50%

Adjusted Expense Ratio excludes certain investment-related expenses borne by the Fund, such as the Fund’s estimated annual leverage expense and current and deferred income taxes from the Fund’s consolidated subsidiaries incurred by the Fund’s wholly-owned subsidiaries, none of which are paid to Yieldstreet Management.

The 3.74% includes “estimated annual lever expense” and “subsidiary tax expense,” which are items we don’t see in NICHX. I’m not sure why they include them as they are not paid to Yieldstreet. Perhaps they’re included in the returns of other funds (other funds will have similar expenses, though I don’t often see them itemized like this).

The 1.50% itself, though, is on par with NICHX.

In doing more research on interval funds, you’ll find that they have higher fees, though, so the 1.69% at NICHX and the 1.50% from Yieldstreet are typical. You won’t see fee structures like index funds, and that makes sense; these funds execute complex transactions and do not just track an index.

Do You Need Interval Funds?

Here’s the big question – do you need to invest in interval funds?

I’d argue most people don’t.

If you look at the original poster from Bogleheads, his advisor put at least a million bucks (that’s the minimum for NICHX) into this fund, and he wasn’t even sure why. That’s a bad sign. If you don’t understand, you have to keep asking questions until you do. They work for you, and if they can’t explain it, they aren’t good enough.

As for interval funds in general, are the returns that much better to justify the illiquidity? You can only get 5% out every quarter, so at a minimum, you’re talking five years to exit the holding fully… and that’s if you don’t get pro-rated.

The 1.50%+ fee should also be a big concern. The fee may be justified, but it doesn’t mean you must buy the product. With investing, we have more control over the cost than the returns, so paying a higher fee means our investment has a much higher hurdle to overcome.

For most, you are better off with a simple three-fund portfolio or something similarly simple. There may be some cases where you’d want one (and perhaps one that invests in something else). But for most, it’s a pass. (heck, before you ever get to the higher cost, the illiquidity is enough to make me balk)

As for this asset class, “alternative investments” are fun to read about and study, but they are hardly required in any portfolio. I own some farmland through AcreTrader and art via Masterworks, but that’s small amounts for fun rather than because I think they’re a necessary part of my portfolio.

Other Posts You May Enjoy:

What Happens When An AcreTrader Farm “Fails”

One of my first AcreTrader investments is running into some trouble and looking for a way out. See how AcreTrader handles it and what happens to a California almond farm.

Best Solo 401(k) Providers

A solo 401(k) is a retirement savings plan for self-employed people with no full-time employees. It allows them to save for retirement using pre-tax contributions while benefiting from the same tax advantages in regular 401(k) plans. Here are some of the top solo 401(k) providers available today.

Is Robinhood Gold Worth It?

Robinhood Gold is a $75 per year premium subscription service to Robinhood. It unlocks a few perks but are they worth the annual fee?

Robinhood App Review 2024 – Free Stock, ETF, and Crypto Trades

Robinhood is a popular online broker offering free stock, ETF, crypto, and options trading. They also offer fractional trades, with no account minimums. But the platform doesn’t support some investment types and has limited research tools. Is it worth it? Find out in this Robinhood review.

About Jim Wang

Jim Wang is a forty-something father of four who is a frequent contributor to Forbes and Vanguard’s Blog. He has also been fortunate to have appeared in the New York Times, Baltimore Sun, Entrepreneur, and Marketplace Money.

Jim has a B.S. in Computer Science and Economics from Carnegie Mellon University, an M.S. in Information Technology – Software Engineering from Carnegie Mellon University, as well as a Masters in Business Administration from Johns Hopkins University. His approach to personal finance is that of an engineer, breaking down complex subjects into bite-sized easily understood concepts that you can use in your daily life.

One of his favorite tools (here’s my treasure chest of tools,, everything I use) is Personal Capital, which enables him to manage his finances in just 15-minutes each month. They also offer financial planning, such as a Retirement Planning Tool that can tell you if you’re on track to retire when you want. It’s free.

He is also diversifying his investment portfolio by adding a little bit of real estate. But not rental homes, because he doesn’t want a second job, it’s diversified small investments in a few commercial properties and farms in Illinois, Louisiana, and California through AcreTrader.

Recently, he’s invested in a few pieces of art on Masterworks too.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.